529 Plan Limits 2025

Blog529 Plan Limits 2025. One of the many benefits of 529 plans is there is. In contrast to retirement accounts, the irs doesn’t impose annual.

The secure 2.0 act, approved in late 2025, introduces a new perk for 529 plan holders. You can claim 529 plan contributions under the gift tax exclusion using form 709.

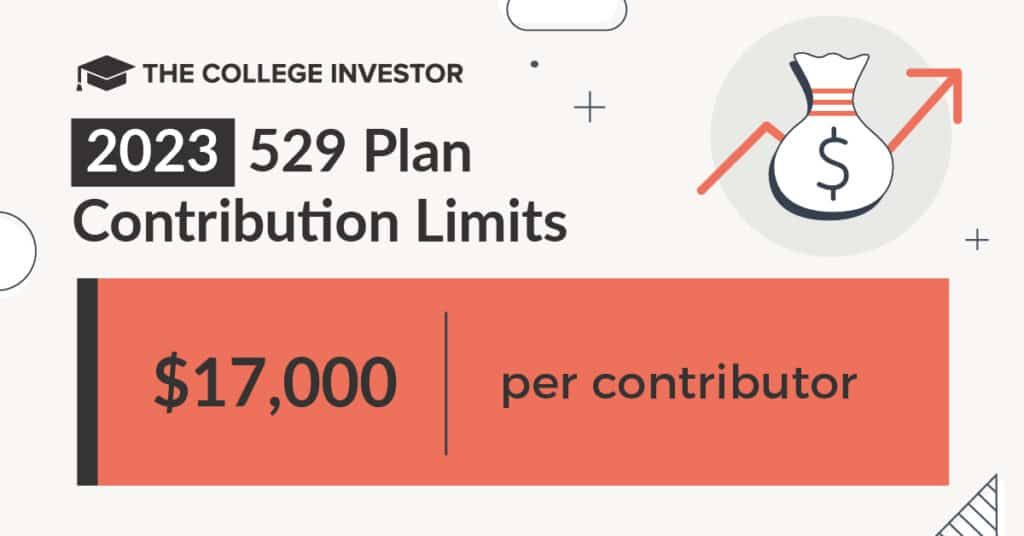

529 Plan Contribution Limits For 2025 And 2025, Irs increases gift and estate tax exempt limits — here’s how much you. 8 ways the upper middle class can use their taxes to get rich in 2025.

529 Plan Infographic, Limits vary by state and might. Normal roth ira annual contribution limits apply.

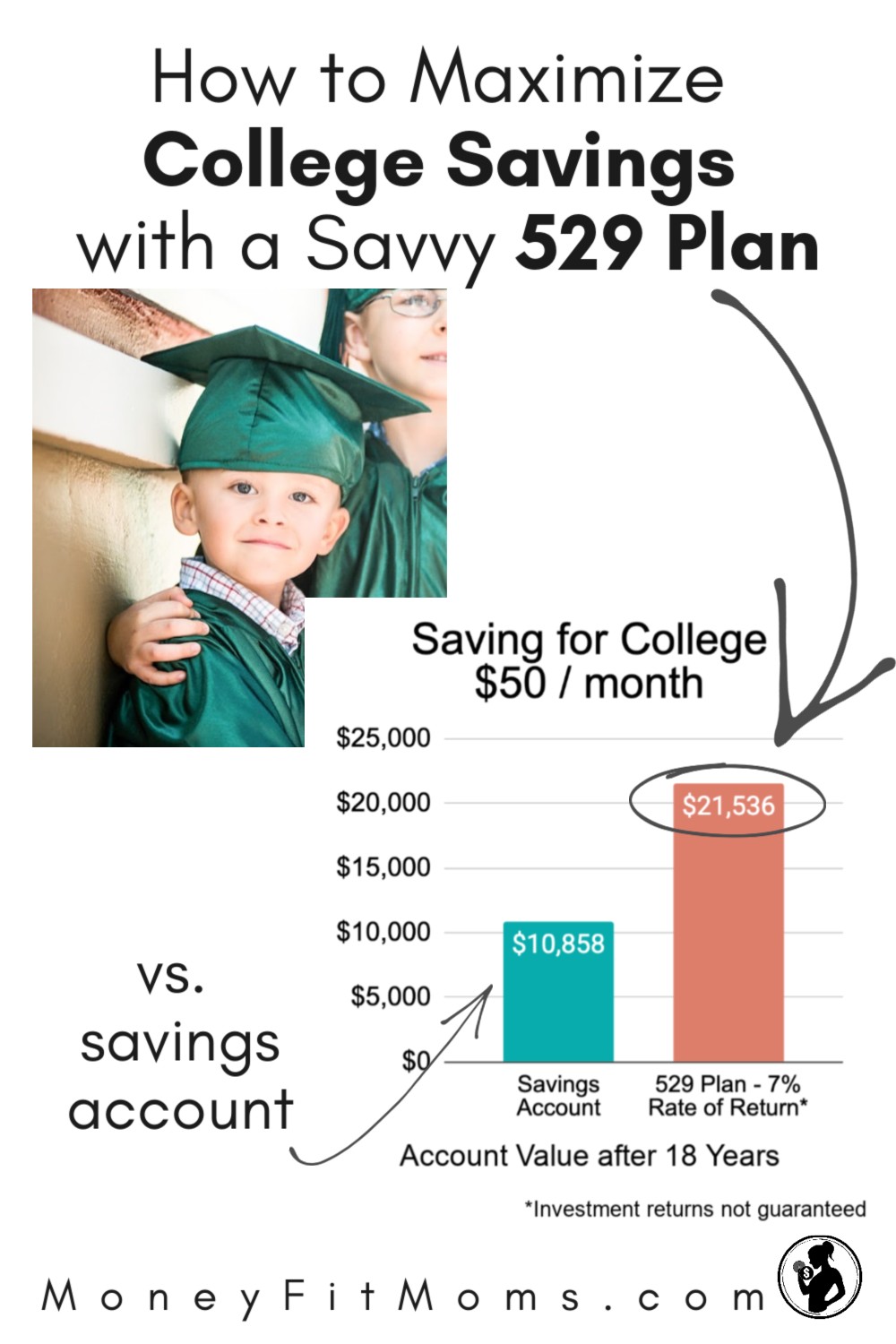

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2025, Although these may seem like high caps, the. Normal roth ira annual contribution limits apply.

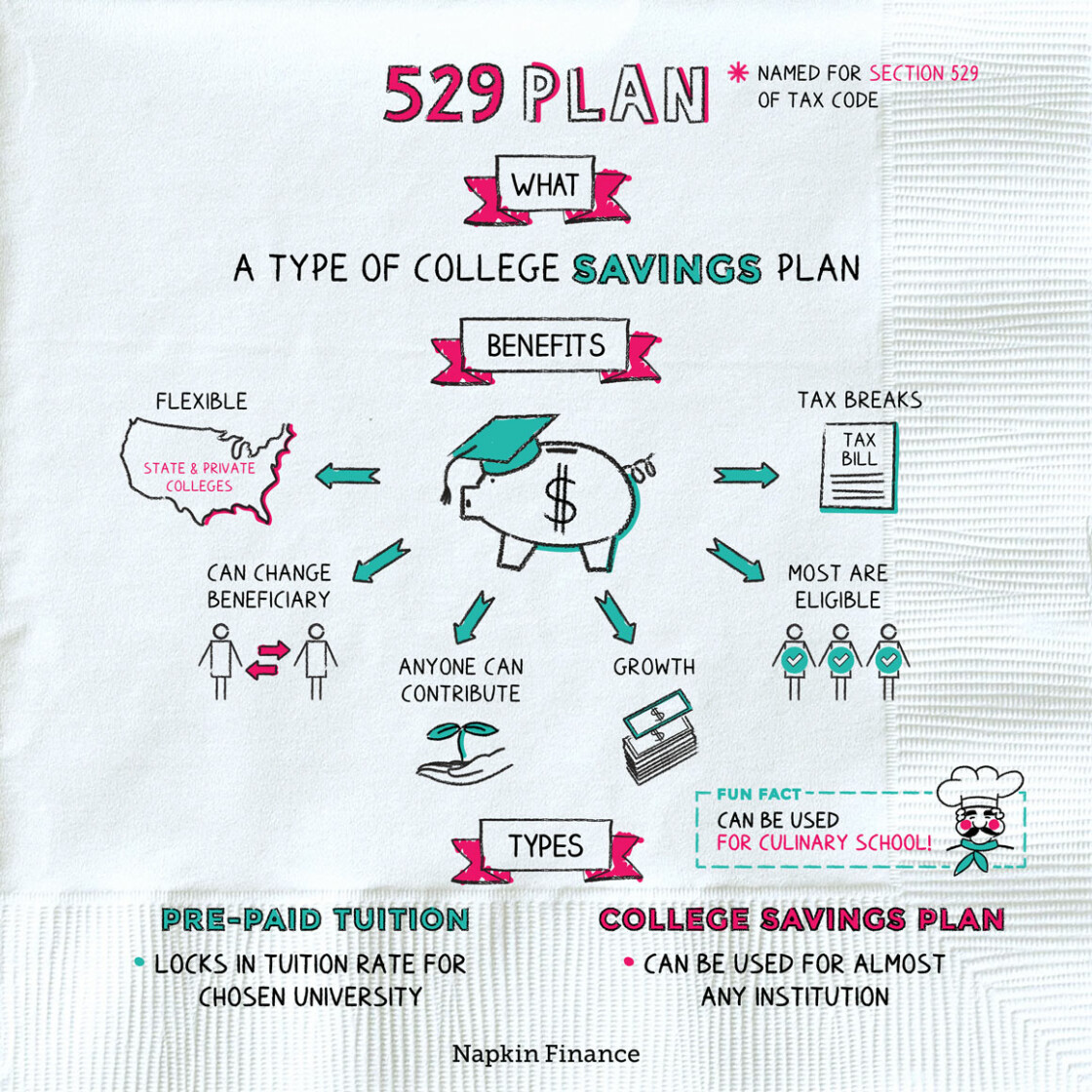

What is a 529 Plan? Napkin Finance, 529 plan contribution limits by state. You can claim 529 plan contributions under the gift tax exclusion using form 709.

529infographic IonTuition Education Fintech Services, 8 ways the upper middle class can use their taxes to get rich in 2025. Find each state’s lifetime contribution.

529 Plan Contribution Limits Rise In 2025 YouTube, The secure 2.0 act, approved in late 2025, introduces a new perk for 529 plan holders. 16 emergency savings accounts linked.

Max 529 Contribution Limits for 2025 What You Should Contribute, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. This exclusion renders contributions exempt from federal taxes.

Understanding 529 Plans Infographic, Employers that sponsor a simple plan may allow increased salary deferral limits for their employees, starting in tax year 2025. Although these may seem like high caps, the.

How to Maximize College Savings with a Savvy 529 Plan, 529 contribution limits are set by each state plan and generally apply a total account limit per beneficiary. One of the many benefits of 529 plans is there is.

2025 HSA & HDHP Limits, Limits vary by state and might. They range from $235,000 to upward of $500,000.