List Of Fsa Eligible Expenses 2025 Irs

BlogList Of Fsa Eligible Expenses 2025 Irs. This publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). For plans that allow a.

The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts. Hsa contribution limit for 2025.

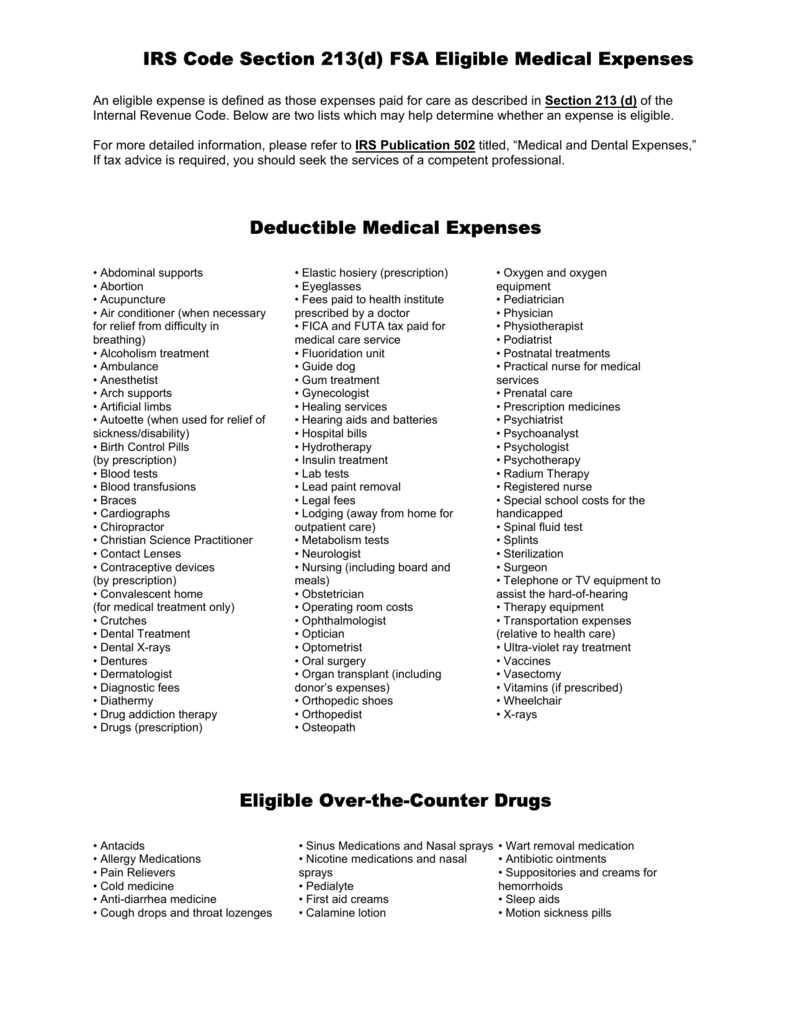

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible, Check out this comprehensive list of eligible expenses and read the important information below. The irs recently announced that.

FSA Eligible Expense List Flexbene, It is the member's responsibility to verify that expenses incurred are designated by the irs and by the plan sponsor as a qme. For plans that allow a.

FSA Eligible Expense List by Peak1 Administration Issuu, For plans that allow a. Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

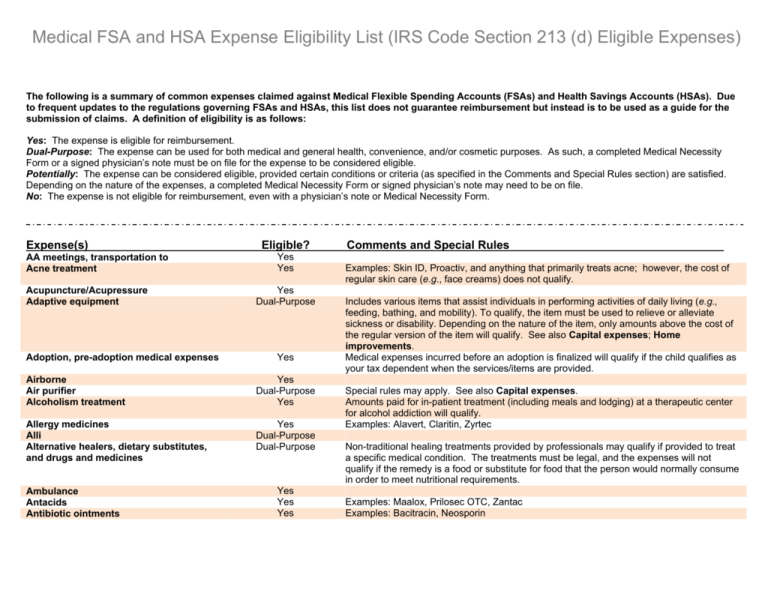

Medical FSA and HSA Expense Eligibility List (IRS Code Section, 2025 & 2025 flexible spending account (fsa) basics: Your fsa funds can help reduce the spread of infection and keep you safe from bacteria and germs.

Dependent Care Fsa Deadline 2025 Dacy Michel, The irs determines which expenses are eligible for reimbursement. The irs published additional faq on their website on march 17, 2025 addressing if certain costs related to nutrition, wellness, and general.

What is an FSA? Definition, Eligible Expenses, & More, The irs recently announced that. What are my fsa eligible expenses?

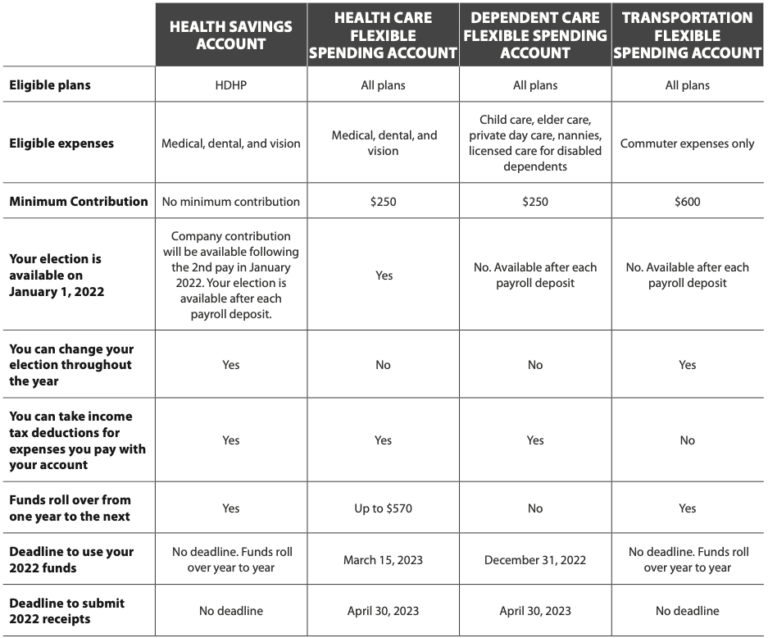

HSA / FSA, The irs determines which expenses are eligible for reimbursement. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions.

2025 FSA limits, commuter limits, and more are now available WEX Inc., Each year, the irs sets the contribution limits for individuals opening an fsa. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below.

Irs Hsa Rules 2025 Randi Carolynn, What expenses are eligible for hsa? The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts.

FSA vs. HSA What's the Difference? Excellent Overview, 2025 single plan family plan; It discusses what expenses, and whose expenses, you can and can't.

The internal revenue service (irs) determines what are considered eligible expenses for all flexible spending accounts.