Us Irs Tax Brackets 2025 Over 65

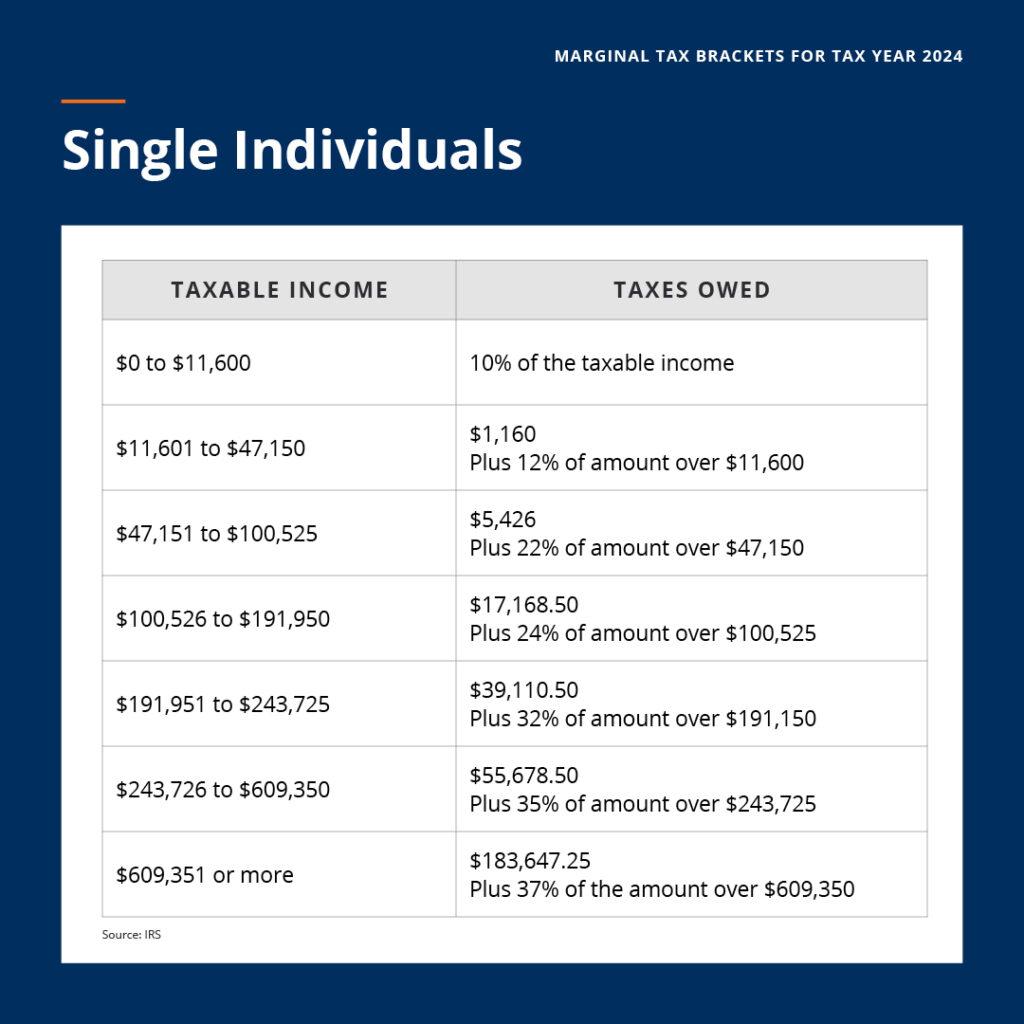

BlogUs Irs Tax Brackets 2025 Over 65. Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. The federal income tax has seven tax rates in 2025:

2025 Tax Brackets For Seniors Over 65 Honey Laurena, Single filers, or individuals who are unmarried or.

Irs 2025 Tax Brackets For Seniors Myra Merlina, 10 percent, 12 percent, 22 percent, 24 percent, 32.

Irs 2025 Tax Brackets Table Single Lena Shayla, Each year, the federal government sets tax brackets that include unique tax rates for different levels of.

2025 Tax Brackets Irs Cam Noelani, Now, if you are 65 or older and blind, the extra standard deduction for 2025 is $3,900 if you are single or filing as head of household.

Standard Tax Deduction 2025 Over 65 Cele Meggie, The federal income tax has seven tax rates in 2025:

2025 Tax Brackets For Seniors Over 65 Single Lonni Randene, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

2025 Tax Brackets For Seniors Over 65 Elna Noelyn, 2025 tax brackets and federal income tax rates.

2025 Tax Brackets And Standard Deduction Table Cate Marysa, Your bracket depends on your taxable income and filing status.

Tax Brackets 2025 Irs Table Kirby Paulita, The internal revenue service (irs) uses tax brackets to determine the income tax you owe.